Cleva for

Local Authorities

Finally, an alternative to traditional prepaid cards. A card designed to give your vulnerable clients guided independence and for you, as the Local Authority, to have full visibility of all spending activity.

Designed with Local Authorities in mind

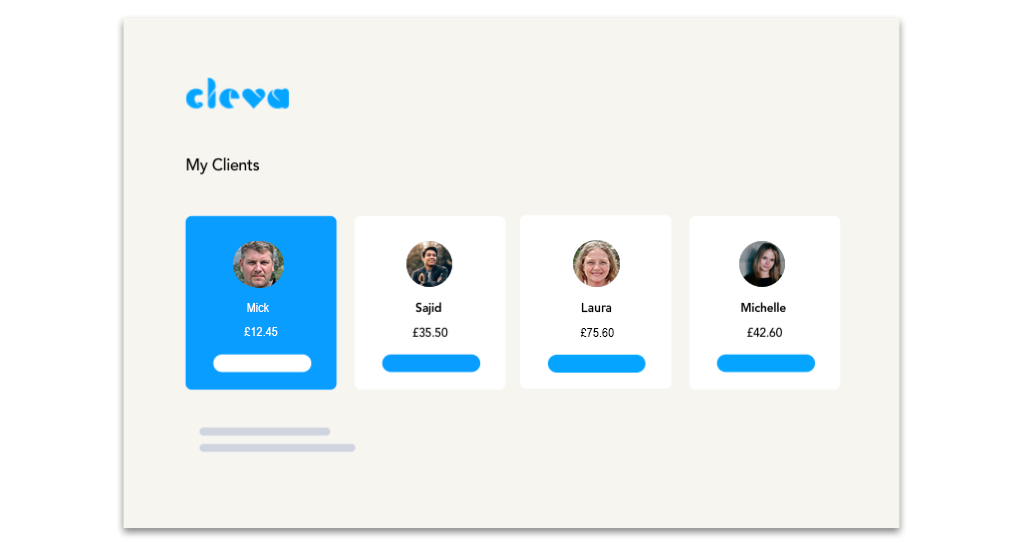

When you are managing the finances of multiple vulnerable clients, traditional prepaid cards lack the flexibility needed to give clients access to their money.

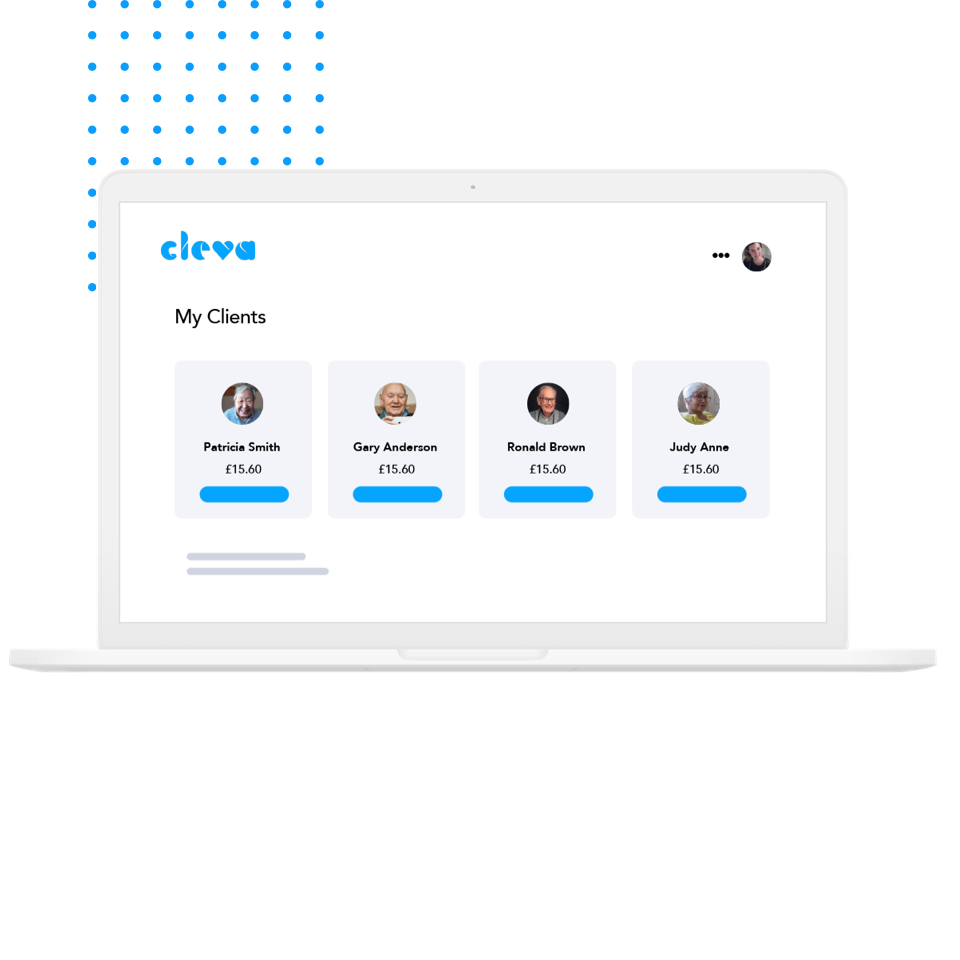

Cleva’s unique card and app gives you the tools to quickly and safely manage payments for the clients under your care.

You can easily issue cards to new clients through our management platform, whilst also having better visibility of spending trends for best interest intervention. Using Cleva also means less third party funds being held or mixed in Local Authority bank accounts.

So how does Cleva work?

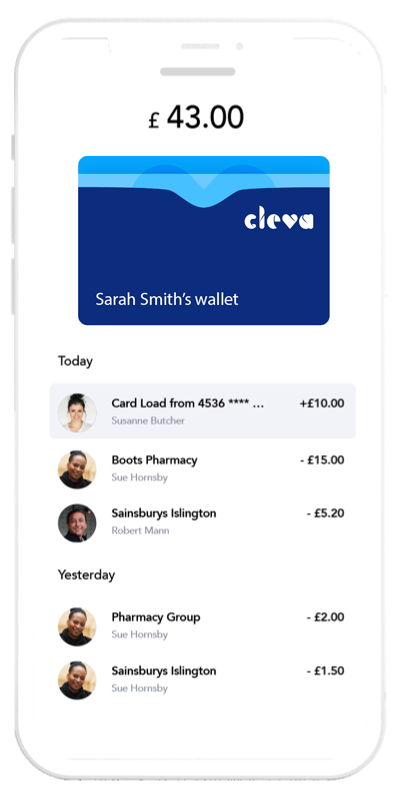

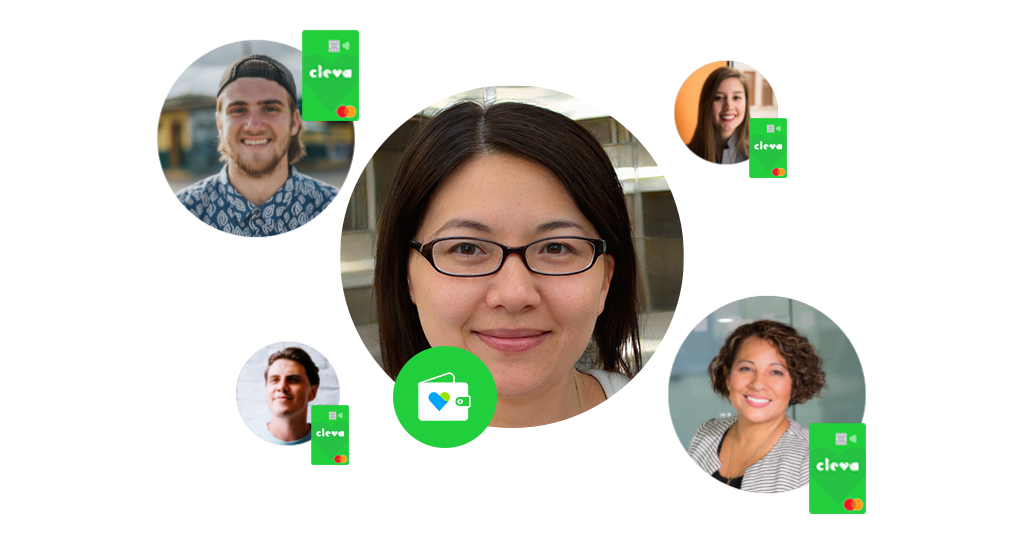

Every client has a digital wallet

Every client has a digital wallet which can be loaded and monitored by you or their Financial Deputy.

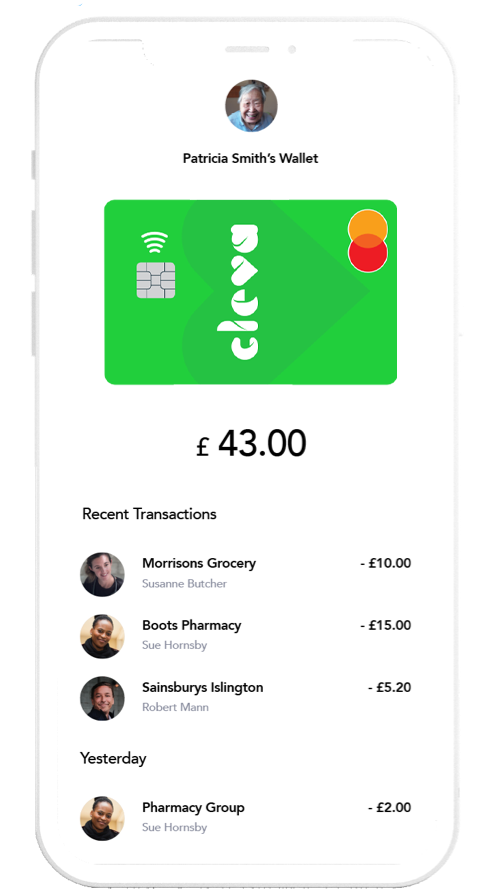

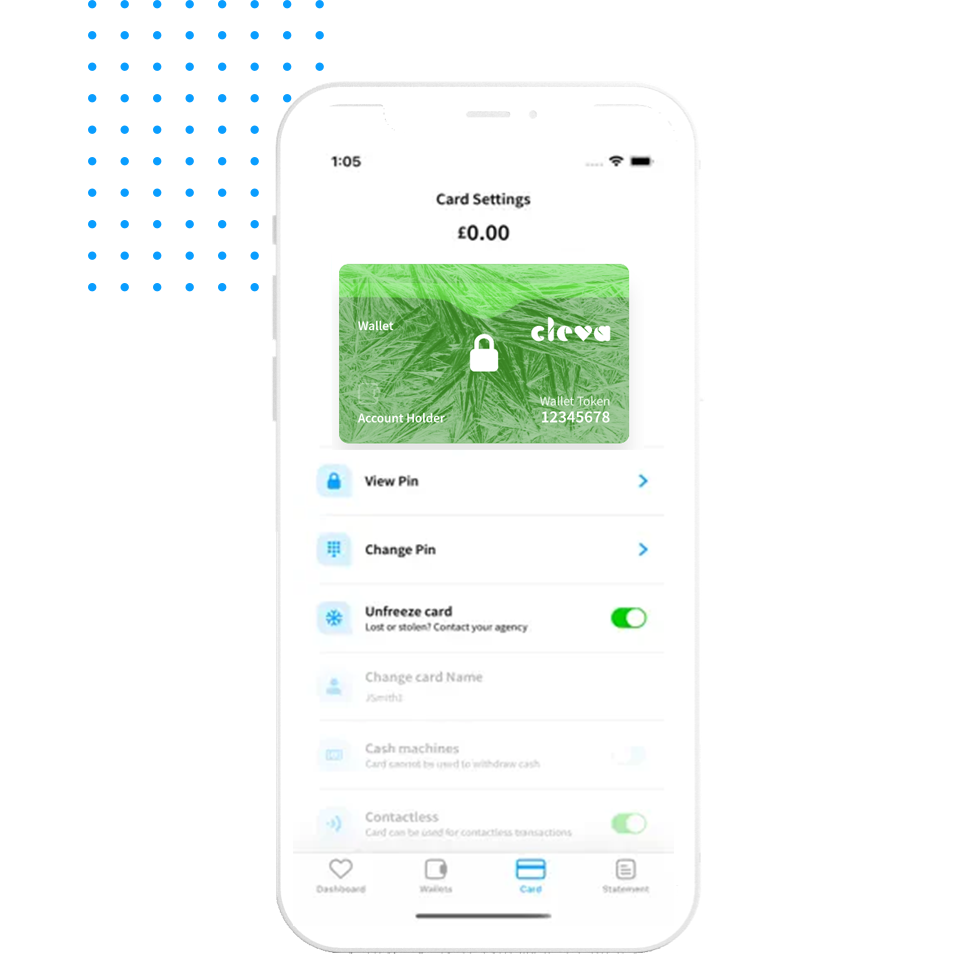

Each client, or care team have a Cleva card

Every client with capacity has a Cleva card which they can use to spend their own money. If they have a care team, the care staff can have a card too, to spend on their behalf.

App access for extra support

Care or support teams can also have app access to help monitor independent spending for capable users

Cleva has the ability to work across numerous clients with varying needs

Mick's Story

Mick has battled addictions for many years.

The Local Authority Deputy supports him both in managing his finances and providing his accommodation. His rent and bills are paid for him, but his day-to-day money for food, travel and socialising has to be collected from the Local Authorities Cash Office each week.

Mick can be victim to drug dealers who know what day he gets this cash, and in the past has had this money stolen from him.

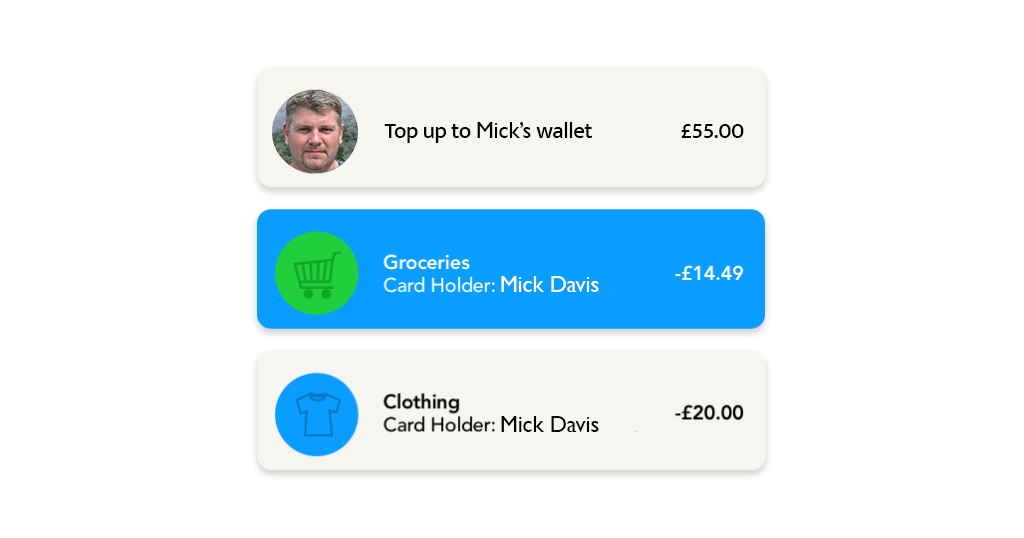

Step 01

Your organisation loads money onto Mick’s Wallet when he needs it

Step 02

Mick spends using his Clevacard. He now no longer has the restrictions or risk which a 'cash only' system has – he can use contactless, get a bus, and no one can take his money

Step 03

Mick's Deputy can monitor his spending, he can help and advise Mick if he sees any worrying spinning trends, or suspend the card if he has a concern that Mick might be being coerced into buying things for other people.

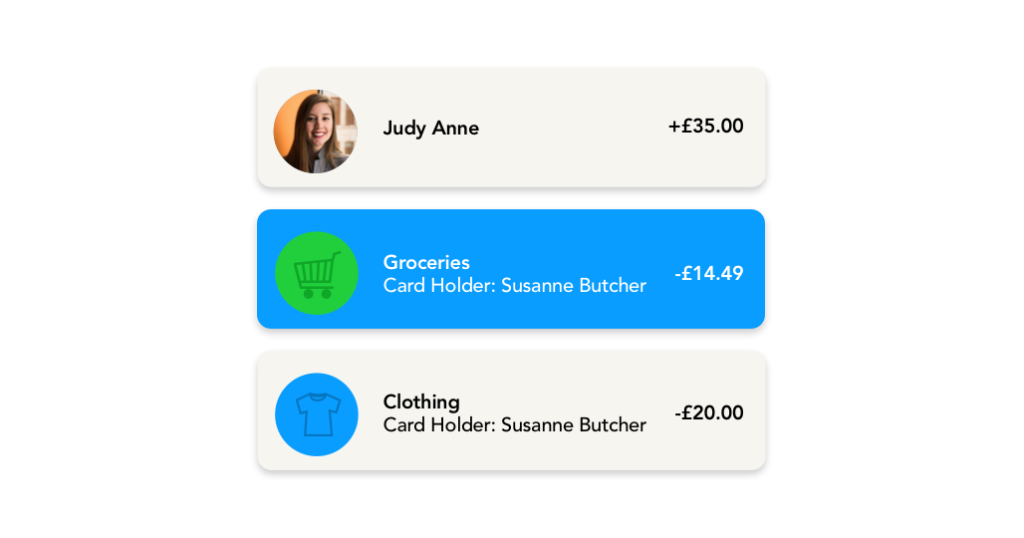

Susan's Story

Susan has physical disabilities and lives in specialist accommodation provided by the Local Authority, who act as her Deputy.

She is active and enjoys going out for coffee with friends. However she struggles to shop and carry goods home, so her Care Team do this for her.

This involves a convoluted process of getting money to the carers, and a time consuming administration of receipts and change etc

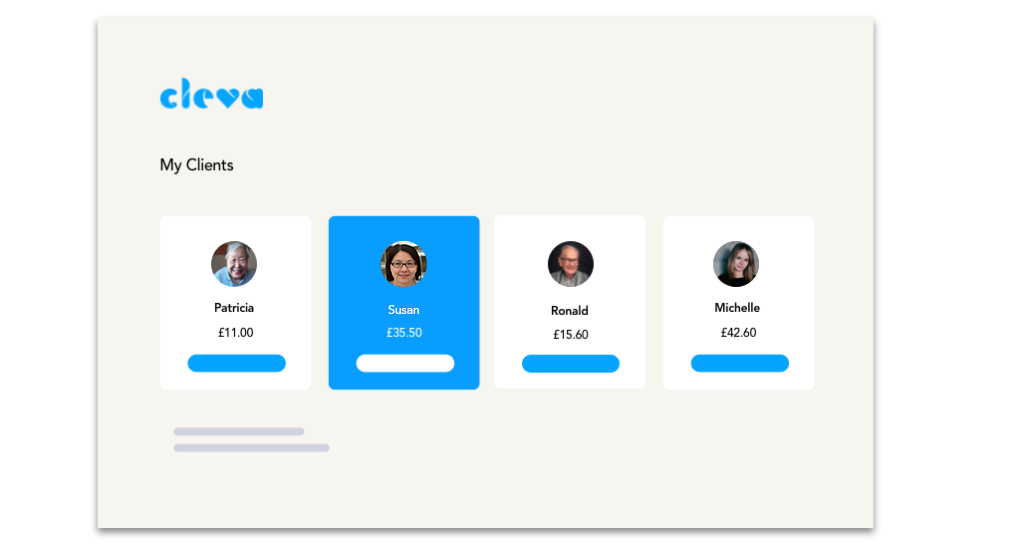

Step 01

Your organisation loads money onto Susan's wallet when she needs it

Step 02

Susan can spend using her Cleva card, but her Care Team can also spend, using their Cleva cards which are linked to her Wallet

Step 03

Susan's Deputy can monitor her spending to ensure she always has access to funds. The Deputy can also monitor every item purchased by Susan's Care Team – seeing who spent what, when, where with a picture of the receipt.

Why use Cleva?

Easy to manage

Load each client’s digital wallet, set card spending controls, and see what’s being spent in real-time – all in one place.

Single card switching

One Cleva card can spend from multiple wallets at the click of a button. If your client has a care or support team who need to shop for them, they can shop safely with full visibility.

No Need for a Cash Office

Managing spending with Cleva not only reduces the risk of holding cash on site, but also removes the need for your clients to carry cash. Their funds are fully protected, and misplaced cards can be instantly frozen and re-issued.

Reduced Admin

All transactions are recorded in your management system to greatly reduce admin and allows you to help your client manage their spending.

Get started with Cleva

To learn more about how Cleva can help your Local Authority, fill in a short form and we’ll get back to you straight away

Some commonly asked questions

-

Where can the Cleva card be used?

Cleva cards can be used almost anywhere that shows the Mastercard® brand mark, in shops and online.rnrnYou can set your account to block purchases from places you don’t want it to be used e.g. bars.

-

What does Cleva cost?

We have flexible pricing plans to meet your business needs. Cleva costs from £9.95 per vulnerable user per month, with no extra charges for cards or admin users. Get in touch for a discussion about your needs and we’ll provide you with a bespoke quote.

-

How long does it take to get set up?

As Cleva is a financial product, we need to run a couple of checks to verify your identity before you can join. This isn’t a complicated process and we can usually have you up and running in just a few weeks.

-

What’s the minimum contract you offer?

The minimum term is 12 months. However special terms may be able to be discussed depending on your business needs.

The Cleva card is issued by Paysafe Financial Services Limited pursuant to a license by Mastercard International.