The core challenge in social care is maintaining trust and eliminating financial risk. To address this, Cleva Card, Care England, and Virgin Money hosted a vital joint webinar focused on moving your organisation away from financial vulnerabilities. (Scroll to the bottom of this blog to find the webinar recording.)

As a result, this essential partnership is driven by a shared commitment to modernise client fund management. It targets the vulnerabilities caused by cash-based and manual systems, aiming to secure funds, increase transparency, and reduce provider liability through digital governance and achieving Care Home Financial Compliance.

The Ultimate Webinar for Care Home Financial Compliance

So, if you are serious about achieving a “Good” or “Outstanding” CQC rating for governance and eliminating the administrative burden of cash management, this session is essential viewing.

The webinar covers:

- Spotting Red Flags: Identifying the signs that signal potential fraud or mismanagement.

- Prevention Measures: Implementing steps before issues can escalate.

- Transparency and Accountability: Strengthening controls to build lasting trust with residents and families.

- Best Practice Governance: Reducing personal and organisational liability exposure.

- CQC Inspection Requirements: Understanding how the management of funds is assessed against regulatory frameworks.

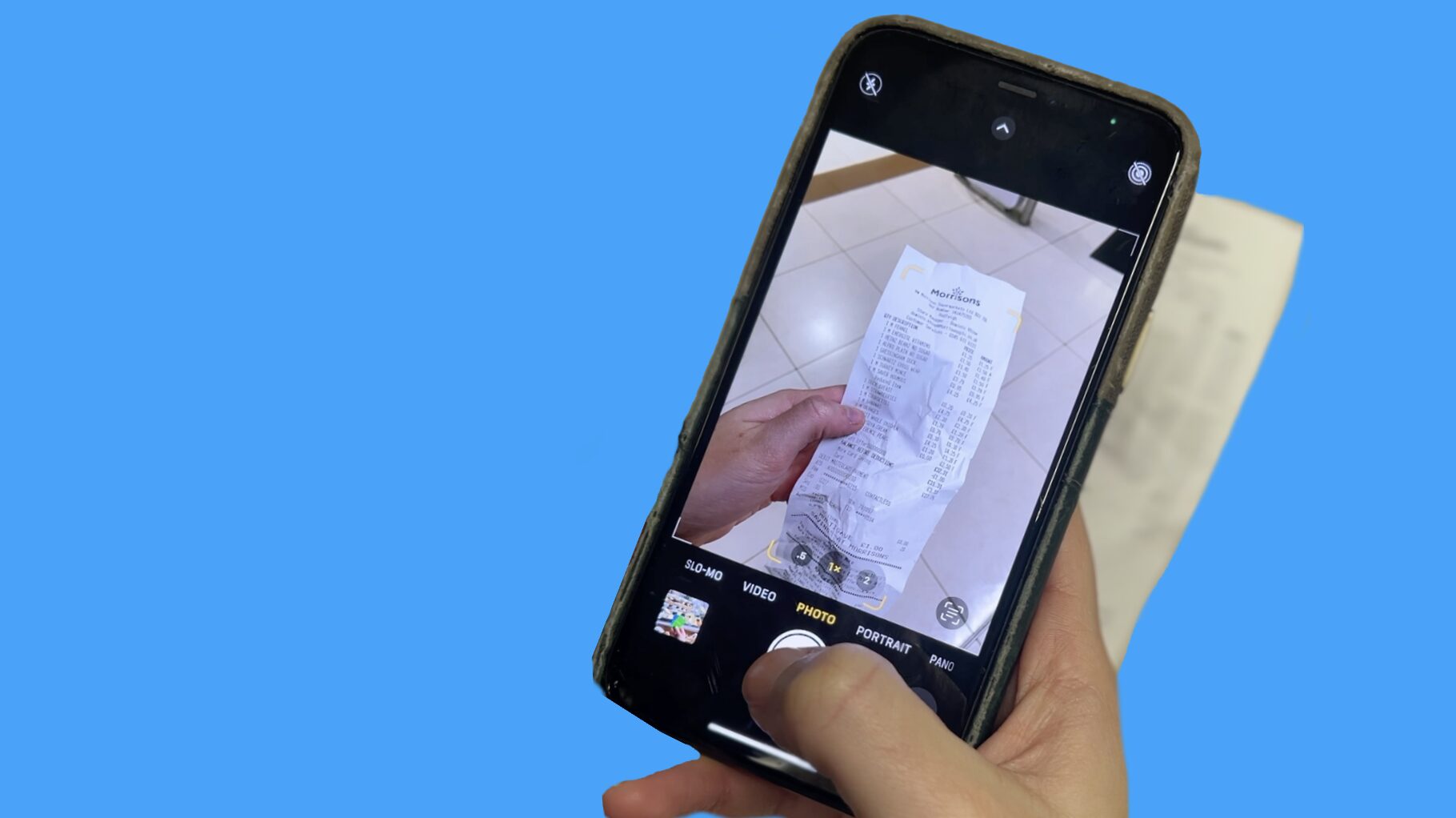

The Everyday Risks of Antiquated Systems

Every day, care providers grapple with managing resident funds. As a result of short-term convenience and time pressures, this task is often executed through manual cash books, spreadsheets, and physical lockboxes. This process is not only time-consuming but fundamentally unsafe.

Aidan of Cleva, speaking on the panel, was explicit about this danger, noting that most financial misconduct occurs precisely where manual systems are still in use.

Whether it’s small amounts of internal fraud or the massive risk of sending staff out to carry large sums of cash, the paper-based approach is the vulnerability itself.

The Regulator’s View: CQC Scrutiny

For CQC registered services, financial management is not an optional extra. In reality, it impacts nearly every quality statement, from Safe and Well-Led to Caring and Effective.

Zoe, a former CQC Inspector, provided a stark warning to the providers in attendance. She stressed that mismanagement is viewed with extreme seriousness.

So, if you want to achieve better Care Home Financial Compliance and understand exactly where you are exposed under the current regulatory framework, our webinar in a must-watch.

(Note: The session included a disclaimer that the webinar is for information purposes only and does not constitute financial advice.)

Ready to Elevate Your Fund Management?

Moving away from cash and spreadsheets is no longer optional: it is essential for modern, compliant, and outstanding Care Home Financial Compliance. Don’t delay fixing the cash crisis in your organisation. Watch the full session now by clicking above.

Interested to find out more about Cleva’s system for managing client funds? Reach out for a no-obligation discussion today.