Cleva for

Appointees and Deputies

Are you a Court of Protection solicitor or case management firm making payments and managing finances for those under your care? Are you a court appointed deputy with responsibilities for vulnerable adults and children, or those under a youth or adult care scheme?

A simple way to handle payments and streamline finances for all those under your care.

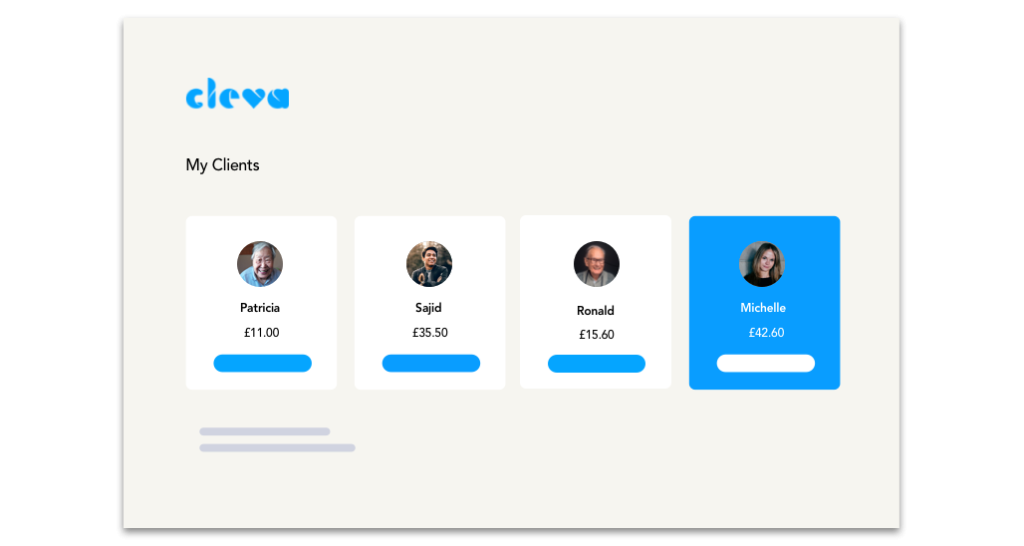

Cleva removes the need to use cash, and saves the time associated with paper receipt reconciliation. Cleva offers a far more advanced system than simple prepaid debit cards, with a dedicated software platform capable of reconciling payments across tens, hundreds or even thousands of accounts. Cleva works with a single sign-on when managing all of your accounts, removing the need to store and access a username and password for each and every user under your care.

It’s so simple!

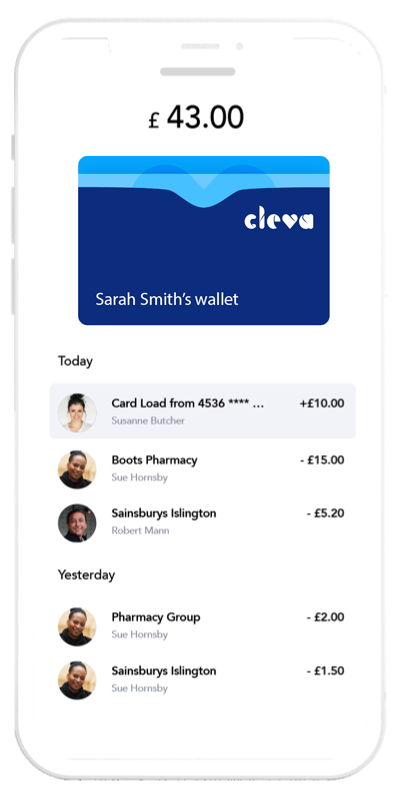

Every client has a digital wallet. You can load money onto this wallet on a regular schedule – for example £50 per week – or you can top it up when required.

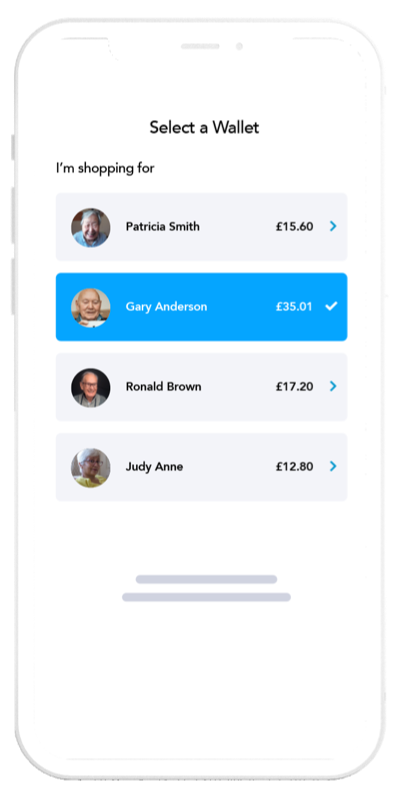

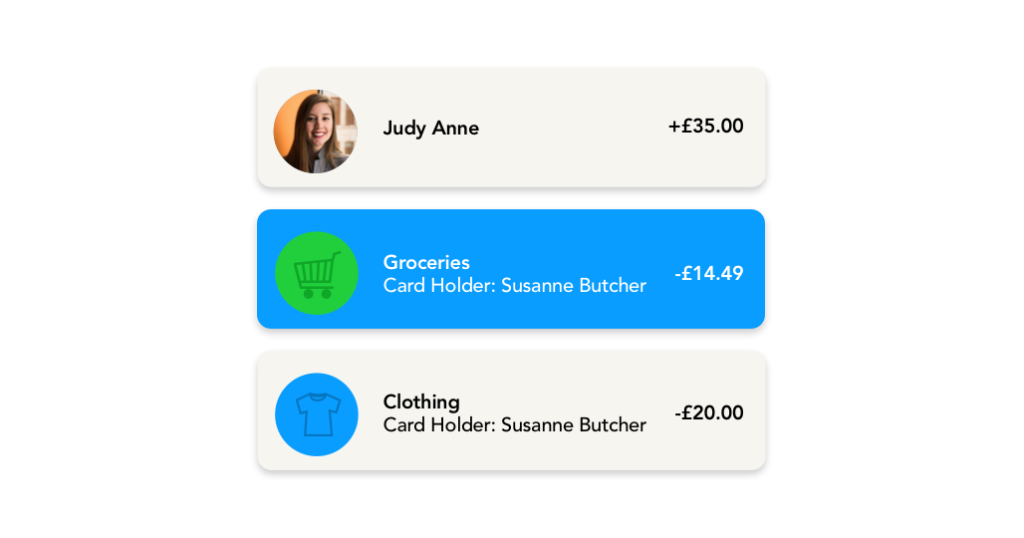

You can link one or more Cleva cards to a wallet. Your client can have their own card, or you can provide one to each of their care team.

Our companion app allows your client, their care team or yourself to see everything they are spending and control how the card(s) are used.

Want to know more?

Download our brochure to find out how Cleva can help your organisation

Want to see something Cleva?

Cleva is a simple and safe way to manage spending by, and on behalf of, your clients.

For Appointees and Deputies Cleva costs just £9.95 per vulnerable client per month, with no hidden fees.

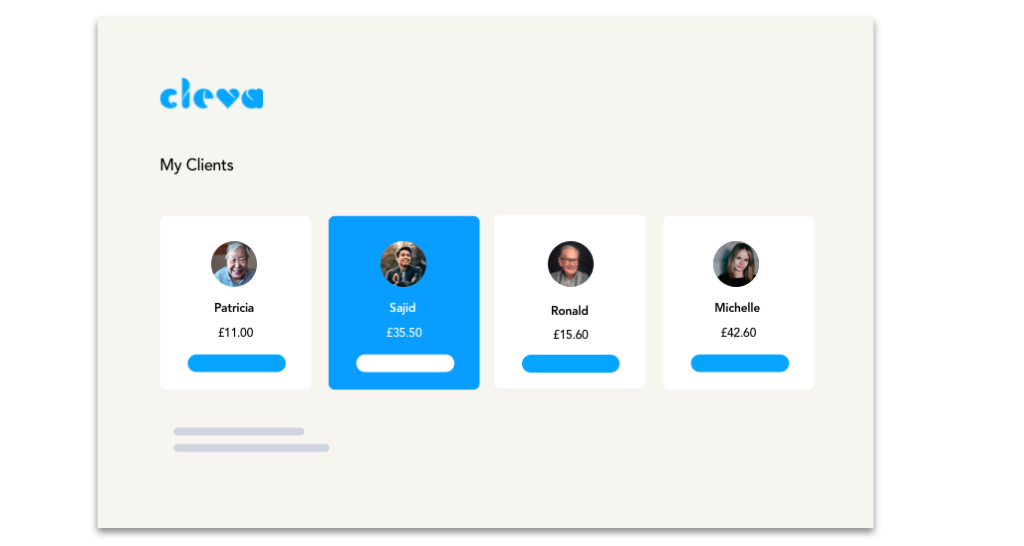

Cleva has the ability to work across numerous clients with varying needs

Michelle's Story

Michelle has a learning disability which means that someone else needs to manage her finances.rnrnShe has a fairly independent life, living alone and shopping for herself, but your organisation is responsible for controlling and monitoring what she spends.

Step 01

Your organisation loads money onto Michelle's wallet when she needs it.

Step 02

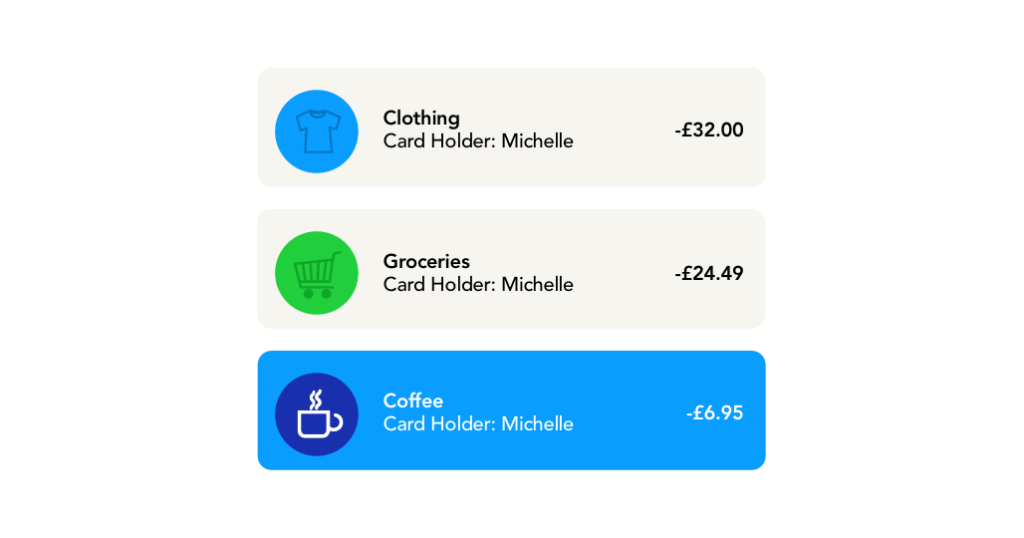

Michelle uses her Cleva card to buy shopping and other essentials.

Step 03

You can monitor Michelle's spending and manage how she uses her card.

Sajid's Story

Sajid has more complex care needs. His physical disability means that he lives in a group home, run by a manager. As with Michelle, your organisation is responsible for controlling and monitoring what he spends. Sajid also has carers who look after his needs: for example, they do his shopping and often take him out for day trips.

Step 01

Your organisation loads money onto Sajid's wallet when he needs it.

Step 02

Each of Sajid's care team has a Cleva card. They use these cards to buy things that Sajid needs.

Step 03

You can monitor what everyone is spending on Sajid's behalf, and control how the cards are used.

Some commonly asked questions

-

Where can the Cleva card be used?

Cleva cards can be used almost anywhere that shows the Visa mark, in shops and online. You can set your account to block purchases from places you don’t want it to be used e.g. bars.

-

What does Cleva cost?

We have flexible pricing plans to meet your business needs. For Appointees and Deputies Cleva costs just £9.95 per vulnerable client per month, with no hidden fees. Get in touch for a discussion about your needs and we’ll provide you with a bespoke quote.

-

How long does it take to get set up?

As Cleva is a financial product, we need to run a couple of checks to verify your identity before you can join. This isn’t a complicated process and we can usually have you up and running in just a few weeks.

-

What's the minimum contract you offer?

The minimum term is 12 months. However special terms may be able to be discussed depending on your business needs.