Cleva for

Supported Living Residents

Our card, app and management platform not only removes the risks and headaches associated with cash but helps to protect your most vulnerable residents from financial abuse. It also provides capable residents with a way to spend their own money safely, increasing their independence while maintaining protections.

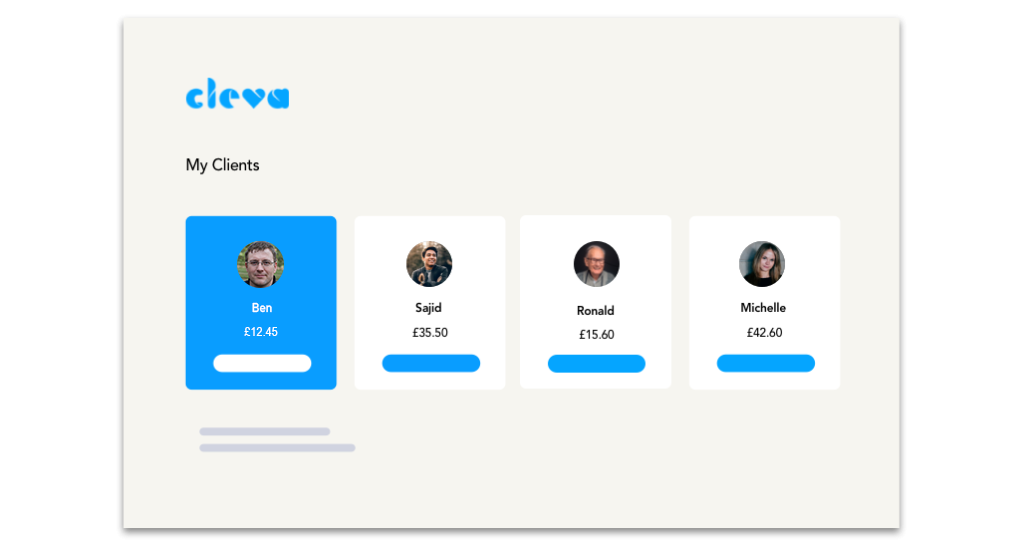

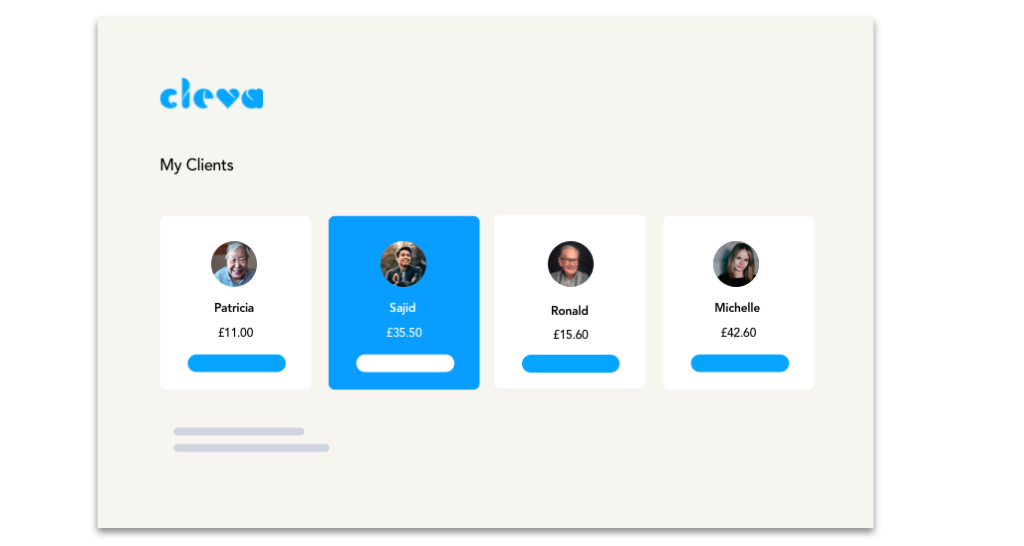

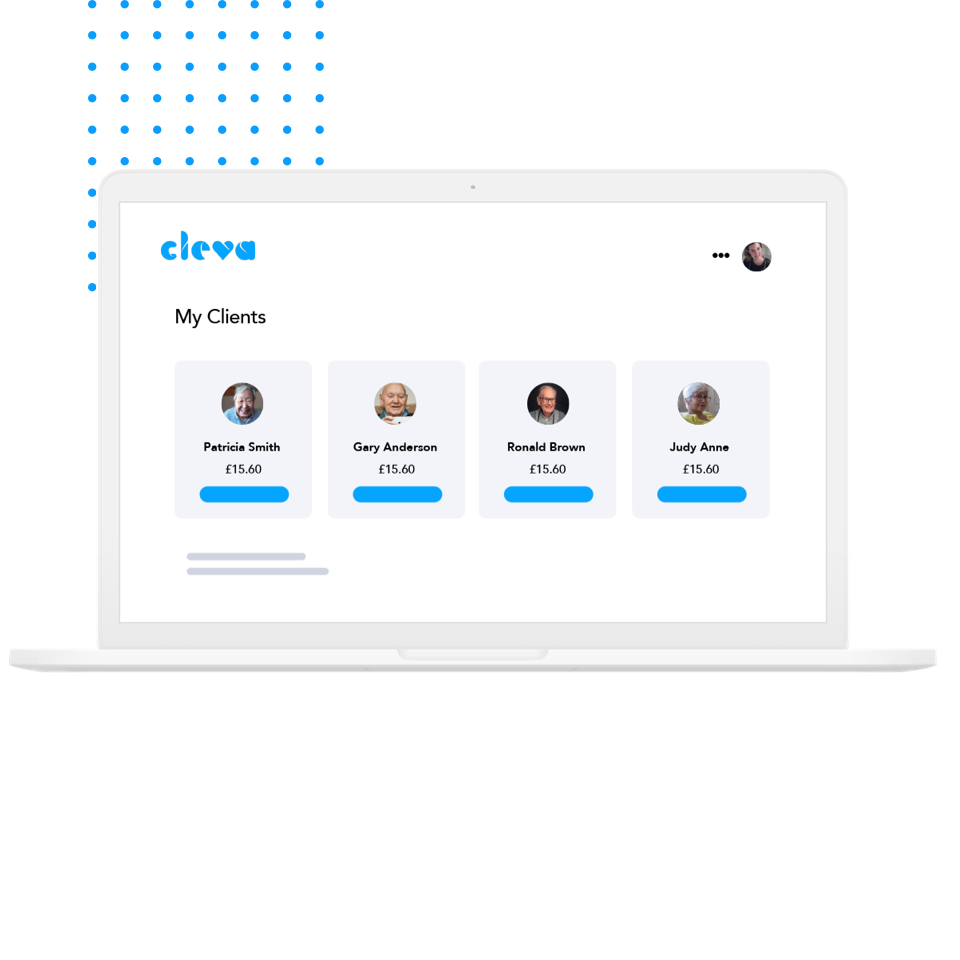

Easily manage finances for multiple residents with complex care needs.

When managing the finances of multiple vulnerable adults with varying support needs, it’s very difficult to track their finances accurately and securely using cash. It’s time-consuming to administer and hard to keep tabs on individual and communal spending.

Cleva provides a new way for support teams to shop for numerous adults under their care, all through a single card. And, it also enables those seeking more independence to have vital autonomy over their own finances, with safeguarding built in.

Cleva is changing the way that adults with complex and severe learning disabilities can lead better and more financially included lives and ensures concerns about financial abuse are greatly reduced.

So how does Cleva work?

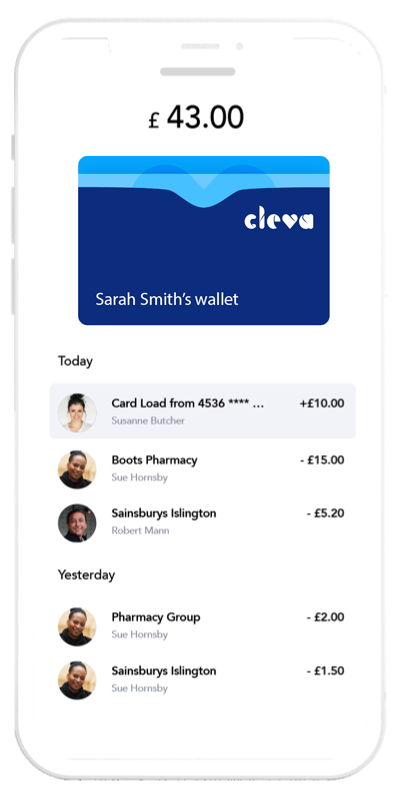

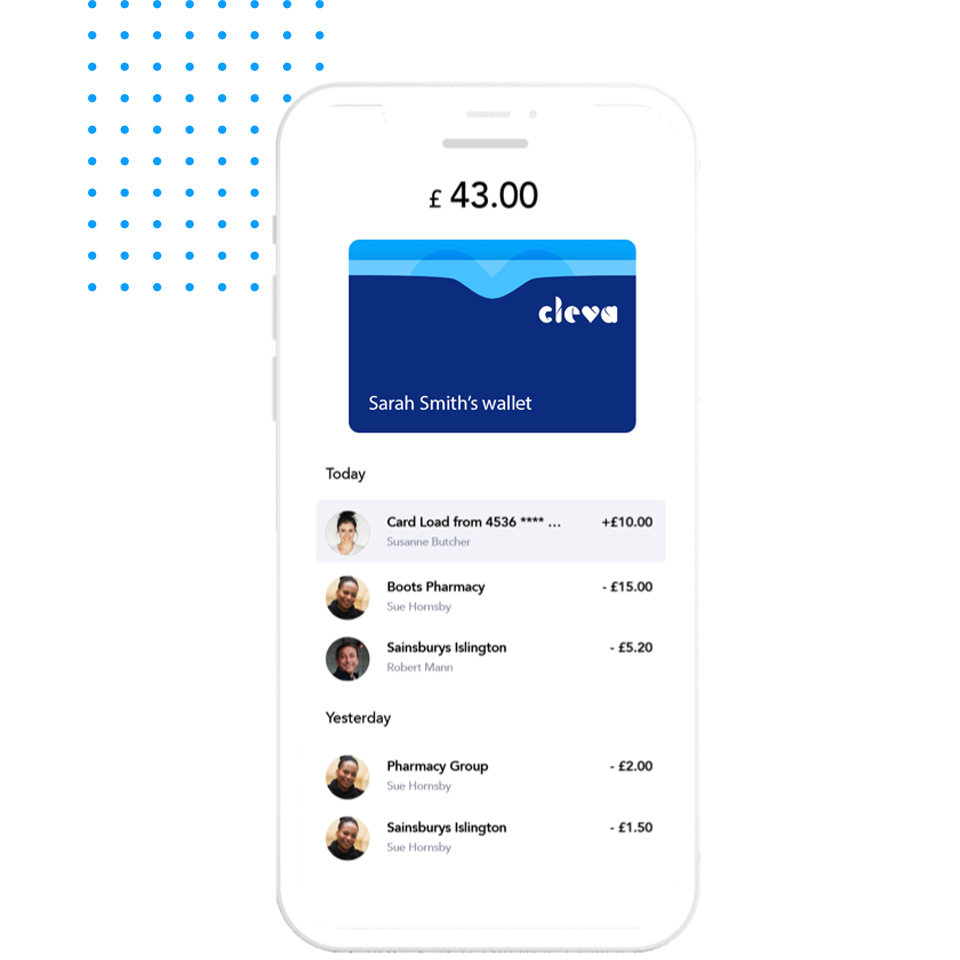

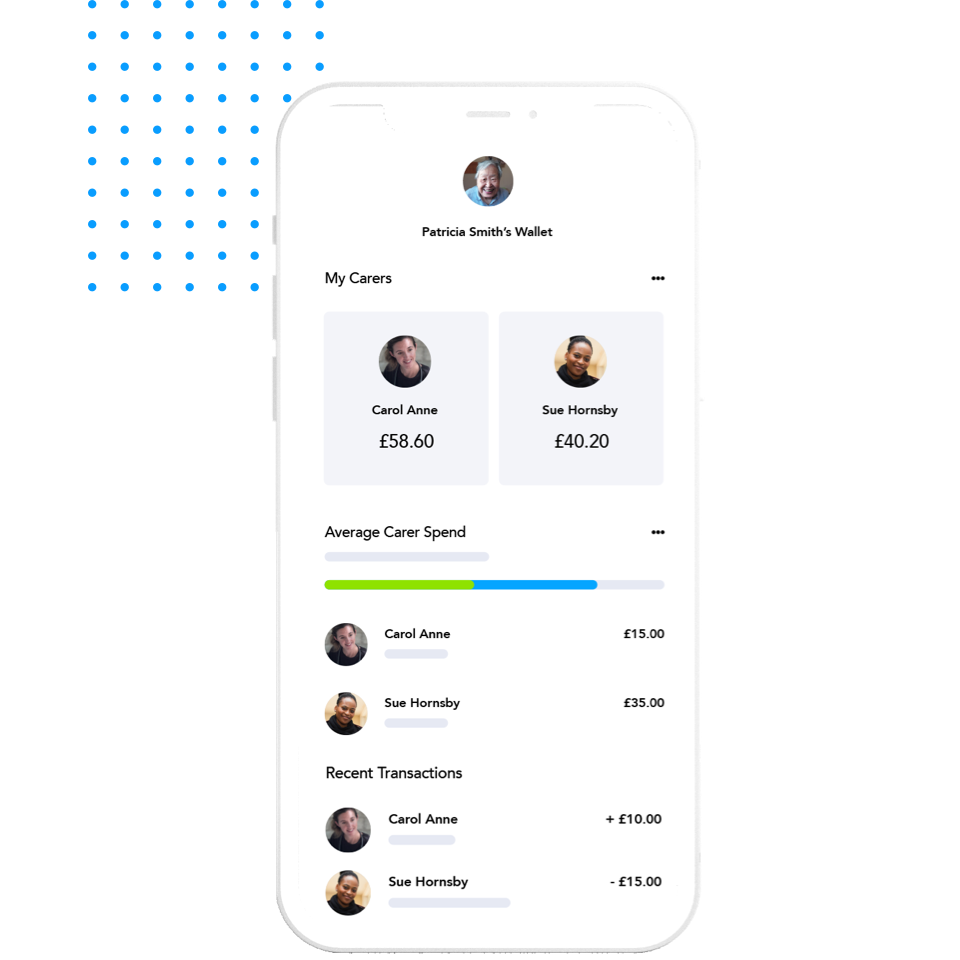

Every resident has a digital wallet

Each resident has a digital wallet. You can load money onto this wallet on a regular schedule, or top it up as required.

Flexible card options

For residents with complex care needs, a Cleva card will be given to each member of their support team. For adults who are more independent, they will be able to have their own Cleva card for monitored spending.

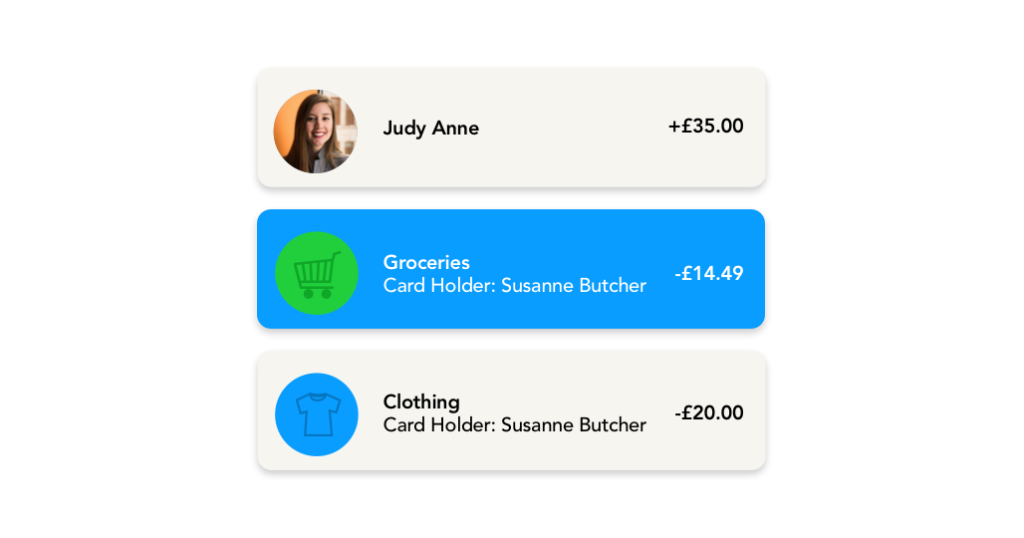

Full visibility with our companion app

Our companion app allows your resident, their support team or yourself to see everything they are spending and control how the card(s) are used.

Cleva has the ability to work across numerous clients with varying needs

Ben's Story

Ben has very complex health needs. He is a full time resident at a supported living home, requires round-the-clock care and has someone to manage his finances.

Ben relies on your organisation to look after his personal and financial needs.

He has a support team who do his shopping and take him out on day trips.

Step 01

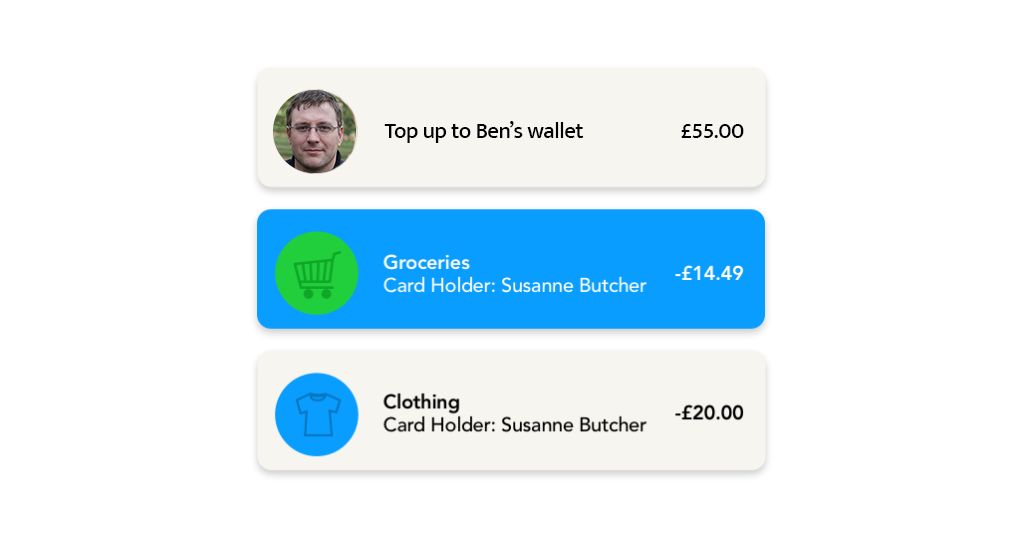

Your organisation loads money onto Ben’s Wallet when he needs it

Step 02

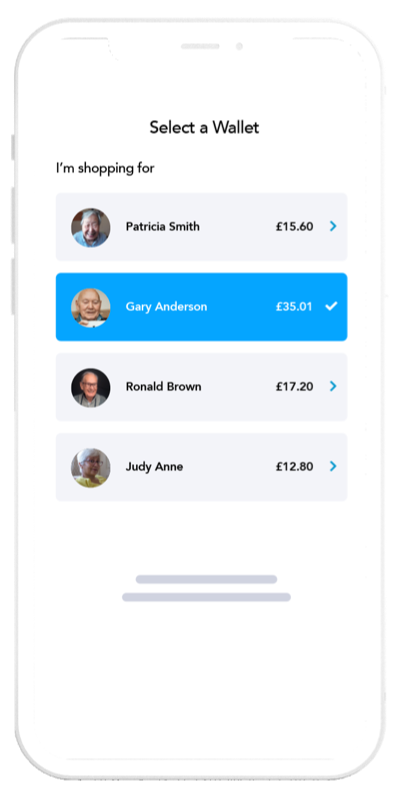

Each of Ben’s support team has a Cleva card, which can spend directly from Ben’s wallet and buy things that Ben needs.

Step 03

All spending is tracked and recorded and your management team has full visibility on what is being spent, where, when and by whom.

Laura's Story

Laura has learning disabilities which means she needs support and help with her finances.

She lives a more independent life compared to Ben and lives in supported living accommodation or alone with regular visits from support workers. Laura still requires you to manage her finances, but wants more autonomy and to be able to choose what she buys with some level of guidance.

Step 01

Your organisation loads money onto Laura’s wallet when she needs it

Step 02

Laura has her own Cleva card and is able to spend directly from the available balance on her Cleva wallet.

Step 03

You can monitor Laura’s spending activity and help her to live as independently as possible.

Want to know more?

Download our brochure to find out how Cleva can help your organisation

Why use Cleva?

Easy to manage

Load each resident's digital wallet, set card spending controls and see what’s being spent in real-time – all in one place.

Single card switching

One Cleva card can spend from multiple wallets at the click of a button, so there’s no need for your support workers to carry around a stack of cards and no need for the old ‘cash in the envelope’ method.

Time Saving

No petty cash and no cash in envelopes means that support workers can shop easily and safely for multiple residents in one shop.

Reduced admin

All transactions are recorded in your management system to greatly reduce reconciliation time. Staff can also upload receipts to the Cleva app allowing for further alignment of spending.

Safe spending

Every transaction has a timestamp and the details of who used the card, ensuring that every penny is tracked and you, your staff and residents are protected.

Get started with Cleva

To learn more about how Cleva can help your organisation, fill in a short form and we’ll get back to you straight away

Some commonly asked questions

-

Where can the Cleva card be used?

Cleva cards can be used almost anywhere that shows the Visa mark, in shops and online. You can set your account to block purchases from places you don’t want it to be used e.g. bars.

-

What does Cleva cost?

We have flexible pricing plans to meet your business needs. Cleva costs from £6.95 per vulnerable user per month, with no extra charges for cards or admin users. Get in touch for a discussion about your needs and we’ll provide you with a bespoke quote.

-

How long does it take to get set up?

As Cleva is a financial product, we need to run a couple of checks to verify your identity before you can join. This isn’t a complicated process and we can usually have you up and running in just a few weeks.

-

What’s the minimum contract you offer?

The minimum term is 12 months. However special terms may be able to be discussed depending on your business needs.